Spotlights

Chuyên viên phân tích, Cán bộ sản phẩm tín dụng, Chuyên viên phân tích nghiên cứu vốn chủ sở hữu, Chuyên viên phân tích tài chính, Chuyên viên phân tích đầu tư, Chuyên viên phân tích lập kế hoạch, Quản lý danh mục đầu tư, Chuyên viên phân tích bất động sản, Chuyên viên phân tích chứng khoán, Cán bộ tín thác

Người ta nói rằng phải có tiền mới sinh ra tiền, và đầu tư là cách phổ biến nhất để làm điều đó. Từ cổ phiếu, trái phiếu đến bất động sản và tiền điện tử, đầu tư là một trong những phương pháp kiếm lợi nhuận lâu dài đã được kiểm chứng và chứng minh hiệu quả. Tuy nhiên, đầu tư cũng tiềm ẩn nhiều rủi ro vì thị trường luôn biến động do các yếu tố tác động đến doanh nghiệp và nền kinh tế nói chung. Không có gì đảm bảo chắc chắn về lợi nhuận đầu tư, và hoàn toàn có thể mất trắng tiền của bạn.

Đó là lý do tại sao các nhà đầu tư thông thái tìm đến các Nhà phân tích Tài chính, những người có thể tư vấn cho họ những chiến lược phù hợp với ngân sách, mục tiêu, khả năng chấp nhận rủi ro và thời gian của họ. Các Nhà phân tích Tài chính nghiên cứu diễn biến của cổ phiếu, bất động sản và các loại hình đầu tư khác, sau đó cố gắng dự đoán hiệu suất trong tương lai. Vì có rất nhiều yếu tố con người trong phương trình, nên việc phân tích này vừa mang tính nghệ thuật vừa mang tính khoa học.

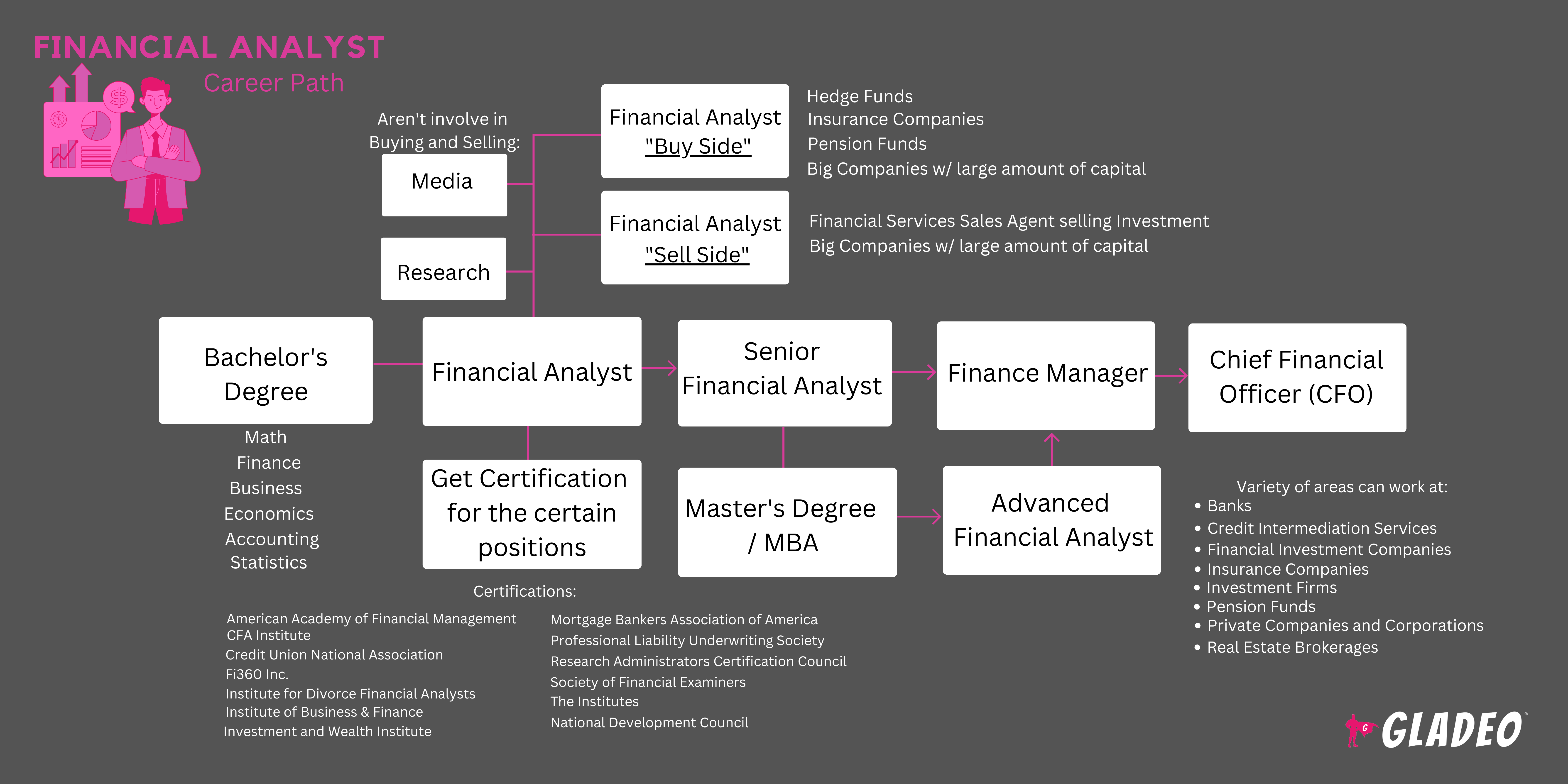

Nhìn chung, các nhà phân tích tài chính tập trung vào "bên mua" (đối với các quỹ đầu cơ, công ty bảo hiểm, quỹ hưu trí và các công ty lớn có lượng vốn đầu tư lớn) hoặc "bên bán" (đối với các đại lý dịch vụ tài chính bán các quyền chọn đầu tư). Một số người làm việc chuyên biệt cho các công ty truyền thông và nghiên cứu, những công ty không tham gia vào việc mua hoặc bán. Họ có thể chuyên về các khu vực, ngành hoặc sản phẩm cụ thể.

Phân tích Tài chính là một lĩnh vực nghề nghiệp rộng mở để khám phá! Thuật ngữ "Phân tích Tài chính" bao gồm các chuyên gia rủi ro tài chính, quản lý quỹ và danh mục đầu tư, nhà phân tích đầu tư, nhà phân tích xếp hạng và nhà phân tích chứng khoán. Mỗi vai trò có nhiệm vụ và phạm vi trách nhiệm khác nhau, nhưng tất cả đều gắn liền với lĩnh vực phân tích tài chính năng động.

- Giúp người sử dụng lao động kiếm được lợi nhuận để mang lại lợi ích cho công ty hoặc cá nhân

- Trở thành một phần của thế giới đầu tư, nơi có tác động kinh tế đến mọi người trên Trái đất

- Tìm hiểu cách thức hoạt động của cổ phiếu (cổ phiếu), trái phiếu, tài sản thực (bất động sản, hàng hóa như vàng, dầu) và tiền điện tử như các khoản đầu tư

Lịch làm việc

Các nhà phân tích tài chính làm việc theo lịch trình ban ngày thông thường, có thể làm thêm giờ hoặc làm việc buổi tối tùy theo nhu cầu của khách hàng. Công việc thường diễn ra trong nhà, thỉnh thoảng cần phải đi công tác.

Nhiệm vụ tiêu biểu

- Xem xét tình hình tài chính của khách hàng (báo cáo thu nhập, bảng cân đối kế toán, dòng tiền) để đánh giá nhu cầu vốn, ngân sách đầu tư và khả năng chấp nhận rủi ro của họ

- Xem xét các loại hình đầu tư và danh mục đầu tư để giới thiệu cho khách hàng

- Đề xuất các biện pháp khắc phục đầu tư, tái cấu trúc nợ, tái cấp vốn và các giải pháp khác cho các vấn đề tài chính của chủ lao động

- Chuẩn bị báo cáo và tài liệu thuyết trình có đồ họa giải thích để giúp khách hàng hiểu các lựa chọn

- Nghiên cứu các công ty có cổ phiếu tiềm năng là khoản đầu tư tốt. Thực hiện các chuyến khảo sát thực tế khi cần thiết.

- Đánh giá dữ liệu bán bất động sản lịch sử để dự đoán xem một bất động sản có phải là khoản đầu tư khả thi hay không

- Sử dụng các mô hình và chương trình tài chính để hỗ trợ phát triển các chiến lược đầu tư

- Chú ý đến các xu hướng kinh tế và kinh doanh địa phương, quốc gia và toàn cầu

- Chuẩn bị và thực hiện các kế hoạch hành động đã được phê duyệt cho các khoản đầu tư tài chính, giao dịch và thỏa thuận

- Làm việc với các nhà đầu tư ngân hàng, kế toán, nhân viên quan hệ công chúng, luật sư và các bên liên quan khác

- Đánh giá hiệu suất đầu tư hiện tại và đề xuất điều chỉnh hoặc bán

- Tìm kiếm cơ hội mới để đa dạng hóa, tăng lợi nhuận tiềm năng và giảm thiểu rủi ro

- So sánh chứng khoán trong các ngành công nghiệp khác nhau

- Phân tích dữ liệu liên quan đến giá cả, năng suất và tính ổn định

- Phối hợp với các cơ quan chính phủ khi cần thiết. Đảm bảo tuân thủ các quy định và luật pháp.

- Giúp khách hàng hiểu được những tác động về thuế của các khoản đầu tư

Trách nhiệm bổ sung

- Cập nhật thông tin bằng cách đọc các ấn phẩm tài chính

- Tìm kiếm cơ hội đầu tư “xanh”

- Quảng cáo dịch vụ để thu hút khách hàng mới, khi cần thiết

- Đào tạo và hướng dẫn các nhà phân tích mới

Kỹ năng mềm

- Lắng nghe tích cực

- Khả năng thích ứng

- Phân tích

- Định hướng tuân thủ

- Tư duy phản biện

- Định hướng chi tiết

- Kỷ luật

- Sự nhạy bén về tài chính

- Kiên nhẫn

- Persistence

- Thuyết phục

- Lập kế hoạch và tổ chức

- Kỹ năng giải quyết vấn đề

- Sự hoài nghi

- Phán đoán đúng đắn

- Kỹ năng giao tiếp mạnh mẽ

- Làm việc theo nhóm

- Quản lý thời gian

Kỹ năng kỹ thuật

- Kỹ năng toán học và kế toán

- Hiểu biết sâu sắc về kinh tế và đầu tư

- Am hiểu các luật hiện hành liên quan đến ngành chứng khoán , chẳng hạn như:

- Đạo luật Cải cách Phố Wall và Bảo vệ Người tiêu dùng Dodd-Frank năm 2010

- Đạo luật Cố vấn Đầu tư năm 1940

- Đạo luật Công ty Đầu tư năm 1940

- Đạo luật Khởi nghiệp Doanh nghiệp của Chúng ta năm 2012

- Đạo luật Sarbanes-Oxley năm 2002

- Đạo luật Chứng khoán năm 1933

- Đạo luật giao dịch chứng khoán năm 1934

- Đạo luật về văn bản ủy thác năm 1939

- Phần mềm phân tích như SAS , MATLAB , Spotfire , QlikView , Tableau và MicroStrategy

- Các công cụ kỹ thuật số khác bao gồm Excel , SQL , VBA , Python và R

- Ngân hàng

- Dịch vụ trung gian tín dụng

- Các công ty đầu tư tài chính

- Công ty bảo hiểm

- Quỹ hưu trí

- Các công ty và tập đoàn tư nhân

- Môi giới bất động sản

Các nhà đầu tư rất tin tưởng vào chuyên môn của đội ngũ Chuyên viên Phân tích Tài chính. Đầu tư đúng đắn có thể mang lại lợi nhuận và sự ổn định lâu dài, thường đồng nghĩa với việc nhân viên của công ty có việc làm ổn định. Ngược lại, đầu tư sai lầm có thể khiến doanh nghiệp chịu tổn thất tài chính đáng kể, dẫn đến việc thu hẹp quy mô, sa thải nhân viên, hoặc thậm chí phá sản.

Kỳ vọng rất cao và các nhà phân tích tài chính phải làm việc chăm chỉ để tiến hành nghiên cứu kỹ lưỡng và tạo ra các mô hình chính xác nhằm dự báo những khoản đầu tư tốt nhất cho nhu cầu của khách hàng. Như Zippia chỉ ra, "mặc dù các nhà phân tích tài chính thường được trả lương cao, nhưng trong nhiều trường hợp, điều này lại đi kèm với cái giá phải trả là sự cân bằng lành mạnh giữa công việc và cuộc sống." Làm việc nhiều giờ liền và áp lực từ quá nhiều áp lực khiến một số nhà phân tích bị kiệt sức.

Nền kinh tế đang trải qua những giai đoạn biến động, với các nhà đầu tư như ngồi trên tàu lượn siêu tốc khi giá cổ phiếu, quỹ tương hỗ, ETF , bất động sản và tiền điện tử biến động khó lường. Sự biến động này trái ngược với những gì hầu hết các nhà phân tích tài chính mong muốn khi nói đến việc tích lũy tài sản , nhưng gần đây lại không có nhiều kênh đầu tư an toàn. Có những lựa chọn tương đối an toàn như tài khoản tiết kiệm, trái phiếu, tín phiếu kho bạc và các sản phẩm tương tự, nhưng lợi nhuận từ các khoản đầu tư rủi ro thấp này thậm chí có thể không theo kịp lạm phát. Trong khi đó, một số nhà phân tích lại đề xuất tận dụng giá cổ phiếu giảm, ủng hộ chiến lược "mua khi giá xuống" khi cổ phiếu đang "giảm giá".

Việc số hóa tiền tệ đang trở thành một xu hướng ngày càng phát triển, với nhiều nhà đầu tư xem tiền điện tử và NFT (token không thể thay thế) là một lựa chọn thay thế hấp dẫn cho các phương tiện đầu tư truyền thống. Thực tế, chỉ riêng các nhà đầu tư mạo hiểm đã rót hơn 33 tỷ đô la vào tiền điện tử và blockchain trong năm 2021. Trong khi đó, các ứng dụng giao dịch đã hoàn toàn cách mạng hóa cách mọi người giao dịch hàng ngày, từ đó tác động mạnh mẽ đến toàn bộ thị trường.

Các nhà phân tích tài chính có thể luôn thích tìm hiểu về tiền bạc, cách thức hoạt động của nó và cách sử dụng nó để kiếm thêm thu nhập! Khi lớn lên, họ có thể đã là những doanh nhân tự khởi nghiệp kinh doanh trực tuyến hoặc trực tiếp. Họ có thể thích chơi chứng khoán và tiền điện tử, giao dịch qua ứng dụng di động và tham gia các diễn đàn trực tuyến. Có thể họ thích các lớp toán, tài chính, kinh tế và lập trình ở trường. Những người khác có thể đã tìm đến họ để xin giúp đỡ hoặc lời khuyên về đầu tư, dẫn họ đến nhận ra rằng một ngày nào đó họ có thể biến kỹ năng của mình thành một nghề nghiệp được trả lương cao!

- Công việc Phân tích tài chính cấp đầu vào yêu cầu ít nhất bằng cử nhân về kinh tế, tài chính, kinh doanh, toán học hoặc chuyên ngành liên quan

- Các nhà tuyển dụng lớn có thể muốn các nhà phân tích có bằng thạc sĩ, chẳng hạn như MBA

- Một số vai trò phân tích đòi hỏi sự hiểu biết về vật lý, toán ứng dụng và các nguyên tắc kỹ thuật

- Có nhiều chứng chỉ có thể giúp bạn đủ điều kiện cho một số vị trí nhất định. Bao gồm:

- Học viện Quản lý Tài chính Hoa Kỳ - Nhà phân tích tài chính được công nhận

- Viện CFA - Nhà phân tích tài chính được chứng nhận

- Hiệp hội tín dụng quốc gia - Chuyên gia đầu tư tín dụng được chứng nhận

- Fi360 Inc. - Ủy thác đầu tư được công nhận

- Viện phân tích tài chính ly hôn - Nhà phân tích tài chính ly hôn được chứng nhận

- Viện Kinh doanh & Tài chính -

• Chuyên gia thu nhập được chứng nhận

• Chuyên gia quỹ được chứng nhận

- Viện Đầu tư và Tài sản - Chuyên viên phân tích quản lý đầu tư được chứng nhận

- Hiệp hội Ngân hàng Thế chấp Hoa Kỳ - Nhà bảo lãnh nhà ở được chứng nhận

- Hiệp hội bảo hiểm trách nhiệm nghề nghiệp - Nhà bảo hiểm trách nhiệm nghề nghiệp đã đăng ký

- Hội đồng chứng nhận quản trị viên nghiên cứu - Quản trị viên nghiên cứu tài chính được chứng nhận

- Hội Kiểm tra Tài chính -

• Chuyên viên thẩm định tài chính được chứng nhận - Chuyên viên phân tích tài chính

• Chuyên gia thẩm định tài chính được công nhận - Chuyên gia phân tích tài chính

- Các Viện - Cộng sự trong Bảo hiểm thương mại

- Hội đồng Phát triển Quốc gia - Chuyên gia Tài chính Phát triển Kinh tế

- Các nhà phân tích tài chính bán sản phẩm cần có giấy phép từ Cơ quan Quản lý Ngành Tài chính (FINRA). Giấy phép thường được cấp sau khi nhà phân tích bắt đầu làm việc.

- Hãy cố gắng quyết định sớm xem bạn có dự định theo đuổi bằng thạc sĩ hay không. Có thể sẽ dễ dàng hơn nếu bạn hoàn thành cả bằng cử nhân và thạc sĩ tại cùng một trường.

- Xem xét chi phí học phí, giảm giá và các cơ hội học bổng địa phương (ngoài viện trợ liên bang)

- Hãy suy nghĩ về lịch trình và sự linh hoạt của bạn khi quyết định đăng ký vào một chương trình trong khuôn viên trường, trực tuyến hay kết hợp

- Kiểm tra các giải thưởng và thành tích giảng viên của chương trình để xem những gì họ đã làm việc

- Xem lại số liệu thống kê vị trí việc làm và chi tiết về mạng lưới cựu sinh viên của chương trình

- Hãy cân nhắc việc nộp đơn xin việc làm bán thời gian trong lĩnh vực kế toán hoặc tài chính

- Học tập chăm chỉ các lớp toán, tài chính, kinh tế, thống kê, kinh doanh, vật lý và khoa học máy tính/lập trình

- Tham gia các hoạt động tình nguyện của sinh viên, nơi bạn có thể quản lý tiền bạc và học các kỹ năng mềm thiết thực

- Tìm hiểu về các loại vai trò khác nhau của Nhà phân tích tài chính, chẳng hạn như chuyên gia rủi ro tài chính, quản lý quỹ và danh mục đầu tư, nhà phân tích đầu tư, nhà phân tích xếp hạng và nhà phân tích chứng khoán

- Xem trước các bài đăng tuyển dụng để biết yêu cầu trung bình. Nếu bạn biết mình muốn làm việc cho công ty hoặc nhà tuyển dụng nào, hãy yêu cầu sắp xếp một buổi phỏng vấn thông tin với một trong những chuyên viên phân tích đang làm việc của họ để tìm hiểu thêm về công việc và nhu cầu của khách hàng.

- Tìm kiếm cơ hội thực tập và trải nghiệm hợp tác tại trường đại học

- Theo dõi tên và thông tin liên lạc của những người có thể làm người tham khảo cho công việc trong tương lai

- Nghiên cứu sách, bài viết và video hướng dẫn liên quan đến các loại hình đầu tư khác nhau. Tham gia các nhóm thảo luận trực tuyến thực tế và dựa trên phân tích thực tế.

- Hãy cân nhắc xem bạn có muốn chuyên sâu vào một lĩnh vực, ngành hoặc loại hình đầu tư cụ thể nào không để có thể điều chỉnh chương trình học của mình cho phù hợp.

- Tham gia với các tổ chức chuyên nghiệp để học hỏi, chia sẻ, kết bạn và phát triển mạng lưới của bạn (xem danh sách Tài nguyên > Trang web của chúng tôi)

- Hãy đạt được bất kỳ chứng chỉ liên quan nào ngay khi có thể để củng cố bằng cấp và giúp bạn cạnh tranh hơn trên thị trường việc làm

- Hãy bắt đầu soạn thảo sơ yếu lý lịch của bạn sớm và tiếp tục bổ sung khi bạn thực hiện, để bạn không bỏ sót bất cứ điều gì

- Nếu có thể, hãy tích lũy kinh nghiệm làm việc thực tế trước khi nộp đơn. Các công việc liên quan đến tài chính, kế toán và kinh doanh sẽ rất nổi bật trên hồ sơ xin việc.

- Không cần bằng thạc sĩ để bắt đầu làm việc trong lĩnh vực này, nhưng bằng sau đại học có thể giúp bạn vượt lên trước đối thủ cạnh tranh

- Hãy cho mạng lưới của bạn biết bạn đang tìm việc. Hầu hết các cơ hội việc làm thực sự được tìm thấy thông qua các mối quan hệ cá nhân.

- Hãy xem các cổng thông tin việc làm như Indeed , Simply Hired và Glassdoor , cũng như các trang tuyển dụng của các công ty mà bạn quan tâm đến việc làm.

- Sàng lọc quảng cáo cẩn thận và chỉ áp dụng nếu bạn hoàn toàn đủ điều kiện

- Các chương trình học nghề hoặc trải nghiệm hợp tác liên quan đến tài chính có thể giúp bạn dễ dàng bước chân vào thị trường. Chúng sẽ rất đẹp trên hồ sơ xin việc và có thể cung cấp một số thông tin tham khảo cá nhân cho sau này.

- Tiếp cận các nhà phân tích tài chính đang làm việc để xin lời khuyên tìm việc

- Hãy chuyển đến nơi có nhiều cơ hội việc làm nhất! Các tiểu bang có tỷ lệ việc làm cao nhất cho Chuyên viên Phân tích Tài chính là New York, California, Texas, Illinois và Florida.

- Nhiều công ty lớn tuyển dụng sinh viên tốt nghiệp từ các chương trình địa phương, vì vậy hãy yêu cầu chương trình hoặc trung tâm nghề nghiệp của trường đại học giúp bạn kết nối với các nhà tuyển dụng và hội chợ việc làm

- Các trung tâm hướng nghiệp cũng cung cấp hỗ trợ viết sơ yếu lý lịch và phỏng vấn thử !

- Hỏi trước các giáo viên và người giám sát cũ nếu họ sẽ phục vụ như là tài liệu tham khảo cá nhân. Đừng khiến họ mất cảnh giác bằng cách liệt kê thông tin liên hệ của họ mà không được phép

- Tạo một tài khoản trên Quora để hỏi những câu hỏi tư vấn việc làm từ những người làm việc trong lĩnh vực này

- Hãy xem các mẫu sơ yếu lý lịch của Chuyên viên phân tích tài chính để có thêm ý tưởng

- Điều chỉnh sơ yếu lý lịch của bạn cho phù hợp với công việc bạn đang ứng tuyển, so với việc gửi cùng một sơ yếu lý lịch cho mọi nhà tuyển dụng

- Liệt kê tất cả các bằng cấp, kỹ năng, đào tạo và lịch sử công việc trong sơ yếu lý lịch của bạn, bao gồm cả số liệu thống kê về lợi tức đầu tư (nếu có)

- Hãy cân nhắc việc nhờ một người viết hoặc biên tập viên chuyên nghiệp soạn thảo hoặc xem xét lại sơ yếu lý lịch của bạn

- Các câu hỏi phỏng vấn Nhà phân tích tài chính để chuẩn bị cho những cuộc phỏng vấn đó

- Ăn mặc phù hợp để thành công trong buổi phỏng vấn xin việc!

- Luôn mang lại cho chủ sử dụng lao động/khách hàng của bạn lợi nhuận đầu tư cao và xây dựng cho họ danh mục đầu tư có thể vượt qua những cơn bão kinh tế

- Làm thêm giờ khi cần thiết để đảm bảo bạn đang làm tốt nhất có thể cho những người đã tin tưởng giao phó tiền bạc cho bạn

- Hãy nghiêm túc thực hiện trách nhiệm quản lý tiền của người khác

- Hiểu và tuân thủ mọi yêu cầu pháp lý và đạo đức

- Sử dụng các chương trình và kỹ thuật mới nhất để tối đa hóa lợi nhuận

- Tìm hiểu càng nhiều càng tốt về các khía cạnh khác nhau của phân tích tài chính, đồng thời chuyên sâu vào lĩnh vực bạn đã chọn

- Hãy bắt đầu ở những vai trò cấp đầu vào sau đó thăng tiến lên những vị trí có trách nhiệm cao hơn, chẳng hạn như quản lý danh mục đầu tư hoặc quản lý quỹ

- Hãy lấy giấy phép FINRA ngay khi bạn có thể và lấy các chứng chỉ nâng cao khi bạn có đủ kinh nghiệm làm việc

- Một trong những chứng chỉ phổ biến nhất là chứng chỉ Nhà phân tích tài chính được cấp bởi Viện CFA

- Nếu bạn chưa có bằng thạc sĩ, hãy cân nhắc việc học chương trình MBA vào ban đêm trong khi làm việc

- Hãy cho người quản lý của bạn biết khi nào bạn sẵn sàng giải quyết nhiều dự án hơn hoặc lớn hơn

- Hợp tác hiệu quả trong nhóm, giữ bình tĩnh và tập trung, và thể hiện khả năng lãnh đạo khi có cơ hội

- Phát triển mạng lưới của bạn bằng cách tham gia vào các tổ chức chuyên nghiệp

Các trang web

- Học viện Quản lý Tài chính Hoa Kỳ

- Hiệp hội các chuyên gia tài chính

- Viện CFA

- Hiệp hội tín dụng quốc gia

- Công ty TNHH Fi360

- Cơ quan quản lý ngành tài chính

- Học viện Tài chính và Quản lý Toàn cầu

- Viện phân tích tài chính ly hôn

- Viện Kinh doanh & Tài chính

- Viện Đầu tư và Tài sản

- Hiệp hội Ngân hàng Thế chấp Hoa Kỳ

- Hội đồng Phát triển Quốc gia

- Hiệp hội bảo hiểm trách nhiệm nghề nghiệp

- Hội đồng chứng nhận quản trị viên nghiên cứu

- Hội Kiểm tra Tài chính

- Các Viện

Sách vở

- Phân tích cơ bản cho người mới bắt đầu: Phát triển danh mục đầu tư của bạn như một chuyên gia bằng cách sử dụng báo cáo tài chính và tỷ lệ của bất kỳ doanh nghiệp nào mà không cần kinh nghiệm đầu tư , của AZ Penn

- Đầu tư 101: Từ cổ phiếu và trái phiếu đến ETF và IPO, cẩm nang thiết yếu về xây dựng danh mục đầu tư sinh lời , của Michele Cagan CPA

- Phân tích kỹ thuật thị trường tài chính: Hướng dẫn toàn diện về phương pháp giao dịch và ứng dụng , của John J. Murph

- Những điều cốt yếu của phân tích tài chính , của Samuel Weaver

Công việc của một Chuyên viên Phân tích Tài chính đôi khi có thể rất căng thẳng, đặc biệt là khi nền kinh tế gặp khó khăn và việc kiếm được lợi nhuận đầu tư tốt trở nên khó khăn hơn. Thông thường, các nhà phân tích bị đổ lỗi cho kết quả dựa trên những yếu tố nằm ngoài tầm kiểm soát của họ. Theo Cục Thống kê Lao động, một số nghề nghiệp liên quan cần cân nhắc bao gồm:

- Chuyên viên phân tích ngân sách

- Giám đốc tài chính

- Người bảo lãnh phát hành bảo hiểm

- Cố vấn tài chính cá nhân

- Đại lý bán hàng chứng khoán, hàng hóa và dịch vụ tài chính

Ngoài ra, O*Net Online liệt kê các trường liên quan bên dưới:

- Chuyên viên phân tích tín dụng

- Chuyên gia rủi ro tài chính

- Quản lý quỹ đầu tư

Nguồn cấp tin tức

Công việc nổi bật

Các khóa học và công cụ trực tuyến

Kỳ vọng về mức lương hàng năm

Người lao động mới bắt đầu khoảng 79.000 đô la. Mức lương trung bình là 94.000 đô la mỗi năm. Người lao động có nhiều kinh nghiệm có thể kiếm được khoảng 114.000 đô la.

Kỳ vọng về mức lương hàng năm

Người lao động mới bắt đầu khoảng 107.000 đô la. Mức lương trung bình là 132.000 đô la mỗi năm. Người lao động có nhiều kinh nghiệm có thể kiếm được khoảng 170.000 đô la.

Kỳ vọng về mức lương hàng năm

Người lao động mới bắt đầu khoảng 92.000 đô la. Mức lương trung bình là 115.000 đô la mỗi năm. Người lao động có nhiều kinh nghiệm có thể kiếm được khoảng 133.000 đô la.

Kỳ vọng về mức lương hàng năm

Người lao động mới bắt đầu với mức lương khoảng 93.000 đô la. Mức lương trung bình là 119.000 đô la mỗi năm. Người lao động có nhiều kinh nghiệm có thể kiếm được khoảng 182.000 đô la.

Kỳ vọng về mức lương hàng năm

Người lao động mới bắt đầu khoảng 85.000 đô la. Mức lương trung bình là 104.000 đô la mỗi năm. Người lao động có nhiều kinh nghiệm có thể kiếm được khoảng 124.000 đô la.